Computerised Accounting with GST is an important topic for Class 12 students that explains how accounting records are maintained using software along with Goods and Services Tax (GST) compliance. This chapter covers company creation, ledger accounts, vouchers, GST configuration, and report generation. These notes are prepared as per the latest HSC Maharashtra Board syllabus and are useful for theory exams, practicals, and revision.

Computerised Accounting with GST Class 12 Notes

Today every shop and business uses computer software to maintain their accounts. A Computerised Accounting System (CAS) is an Accounting Information System that stores and processes financial transactions according to Generally Accepted Accounting Principles (GAAP) and generates reports as per user needs.

Working of Accounting Software

Process of Accounting Software

1. Creation Company/Organisation

Creating a company/organisation involves basic information about the company, like the name of the company, email ID, address of the company, and when the financial year begins. Books beginning from etc. with admin password.

2. Creation of Ledgers

The modern way of managing accounts, called the ‘single ledger’ concept, A ledger is the main accounting book (or database) where all financial transactions of a business are recorded, organised, and summarised. Groups are categories used in accounting software to classify and organise account heads according to their nature (e.g., assets, liabilities, income, expenses).

3. Selection of Correct Voucher

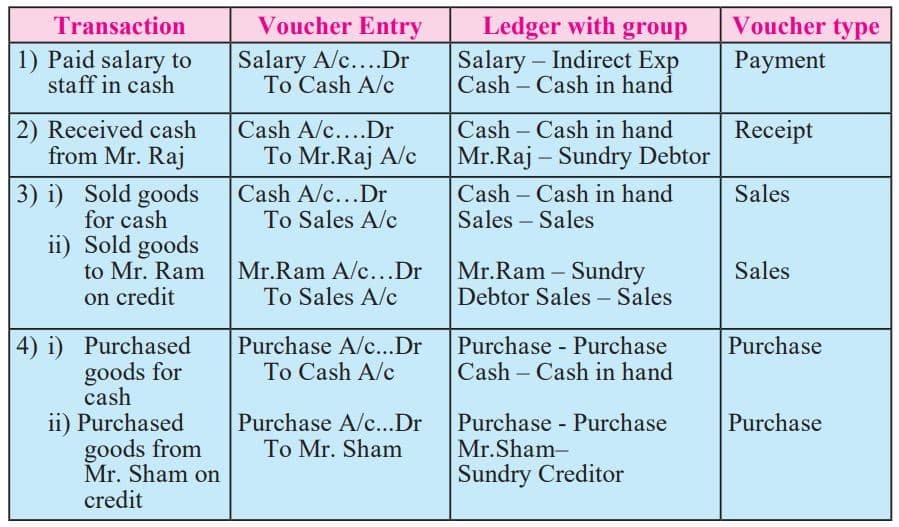

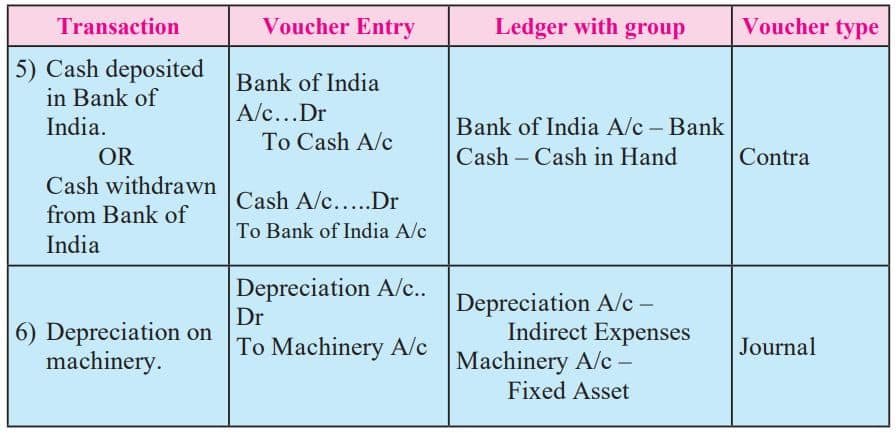

A voucher is a pre-numbered accounting document used for recording daily transactions. Every voucher maintains its debit and credit record. The list of predefined accounting voucher types is as below.

The above table of voucher types can be understood more clearly with the help of following transactions.

4. GST Calculation

GST stands for Goods and Service Tax. GST is an Indirect Tax which has replaced many Indirect Taxes in India. The Act came into effect on 1st July 2017. GST is one nation, one tax. We will study about GST calculation in this chapter.

5. Posting of transaction into Voucher

Posting a transaction through voucher is called voucher entry. While recording a transaction through the voucher, the account to be debited and credited along with the amount.

Steps (procedure for voucher entry)

- Creation of Ledger with appropriate group or sub group.

- Select the appropriate voucher type from voucher menu.

- Enter voucher date.

- Select the debit account name from the list (which you have created) and enter the amount.

- Select the credit account name from the list (which you have created) and enter the amount.

- Enter narration and save.(optional)

6. Displaying various Reports

In Computerised Accounting various financial, inventory reports can be generated after finishing the recording of transactions or even at timely intervals. Reports such as :

- Trial Balance: provides you a report with the debit and credit balance of all ledger accounts.

- Profit and Loss Account: This report gives the final working result of the business with net profit/net loss.

- Balance Sheet : It is a statement showing the assets: and liabilities of the business concern.

- The Day Book: contains all vouchers for the day, including inventory vouchers. Its purpose is to show you a day’s transactions, though you can display a report for any period using the Change period option.

- GST Reports: The GST report prints a summary of the GST received and paid by you, broken down by the various tax codes, and is used to calculate your GST payment or refund.

7. Printing various Reports

Printing of the financial and inventory reports is advisable for future reference. It is also useful for accounting audits. Reports and documents generated through accounting software can also be printed.

Different Accounting Packages

1. Tally with GST package

One of the most widely used financial accounting software. Used by different types of trade and industries. Provides business accounting + inventory management in one system. In 2009, Tally Solutions introduced the software Tally.ERP 9. The software offers comprehensive business management solution. It maintains all books of accounts. In 2017, it was updated to comply with the Indian Goods and Services Tax (GST) requirements.

2. GNU Khata

GNUKhata is a Free and Open Source Software (FOSS) developed by K.K. Foundation in India. It is designed for businesses, NGOs, and educational institutions to manage accounts easily. This software helps you keep track of your inventory.

3. LedgerSMB

A powerful yet simple open source accounting solution. It has been tailored to small and medium sized businesses. Starting from managing invoices to inventory – you also get the ability to translate (up to 45 languages supported).

4. GNUCash

GnuCash is personal and small-business financial-accounting software, freely licensed under the GNU GPL and available for GNU/Linux, BSD, Solaris, Mac OS X and Microsoft Windows. It is designed to be easy to use, yet powerful and flexible. GnuCash allows you to track bank accounts, stocks, income and expenses.

5. Akaunting

Akaunting is an interesting online accounting software that’s available for free. Ranging from invoicing to managing deposits and transfers it has a whole lot of features. It’s fit for both personal and enterprise needs.

Disclaimer: We have provide you with the accurate handout of “Computerised Accounting with GST Class 12 Notes“. If you feel that there is any error or mistake, please contact me at anuraganand2017@gmail.com. The above study material present on our websites is for education purpose, not our copyrights.

All the above content and Screenshot are taken from Information Technology Class 12 Textbook and MSBSHSE (HSC) Support Material which is present in MSBSHSE (HSC) website, This Textbook and Support Material are legally copyright by Maharashtra State Bureau of Textbook Production and Curriculum Research, Pune. We are only providing a medium and helping the students to improve the performances in the examination.

Images and content shown above are the property of individual organisations and are used here for reference purposes only. To make it easy to understand, some of the content and images are generated by AI and cross-checked by the teachers. For more information, refer to the official website.