The topic Introduction to Financial Markets in Class 10 Business Studies explains the meaning, importance, and functions of financial markets in an economy. A financial market helps in the smooth flow of money, encourages investment, and supports economic development.

Concepts and Modes of Analysis Class 10 Notes

What is Simple Interest?

Simple interest is the interest paid only on the principal amount borrowed. No interest is paid on the interest accrued during the term of the loan. There are three components to calculate simple interest: principal, interest rate and time.

SI = P × r × t

Where:

- P = Principal (initial amount)

- r = Rate of interest (per year, in decimal)

- t = Time (in years or fraction of a year)

What is Compound Interest?

Compound interest means that the interest will include interest calculated on interest. The interest accrued on a principal amount is added back to the principal sum, and the whole amount is then treated as new principal for the calculation of the interest for the next period.

Formula for calculating compound interest:

C = P (1+i)

Where

- C = amount

- P = principal

- i = Interest rate per conversion period

- n = total number of conversion periods

The Impact of the Power of Compounding:

What is meant by the Time Value of Money?

Money has time value. The idea behind the time value of money is that a rupee now is worth more than a rupee in the future. The relationship between the value of a rupee today and the value of a rupee in the future is known as ‘Time Value of Money’. A rupee received now can earn interest in the future. An amount invested today has more value than the same amount invested at a later date because it can utilise the power of compounding.

Why Is Time Valuable in Money?

You can earn interest by investing money today. Over time the money grows through compounding; delaying money means missing growth opportunities. For example,

You have two choices:

- Option A: Get ₹10,000 now

- Option B: Get ₹10,000 after 3 years

It’s better to choose Option A because you can invest ₹10,000 now and earn interest. If you have deposited for 3 years, then it will be worth more than ₹10,000.

How is the time value of money computed?

The time value of money may be computed in the following circumstances:

- Future value of a single cash flow

- Future value of an annuity

- Present value of a single cash flow

- Present value of an annuity

1. Future Value of a Single Cash Flow

The future value tells how much a present amount of money will grow after a certain time with interest. It depends on present value (PV), interest rate (r), time (t) and type of compounding, like discrete or continuous.

Discrete Compounding

The discrete compounding formula is:

FV = PV × (1 + r)ᵗ

Where:

- PV = Present Value

- r = Interest rate (in decimal)

- t = Time in years

Example: Deposit = ₹2,000, Rate = 10% = 0.10, Time = 3 years

FV = 2,000 × (1 + 0.10)³ = 2,000 × 1.331 = ₹2,662

Continuous Compounding

The continuous compounding formula is:

FV = PV × eʳᵗ

Where:

- e = exponential constant ≈ 2.7183

- r = Interest rate

- t = Time

Example: Deposit = ₹2,000 Rate = 10% = 0.10 Time = 3 years

FV = 2,000 × e^(0.10 × 3) = 2,000 × 1.349862 = ₹2,699.72

2. Future Value of an Annuity

An annuity is a series of equal cash flows made every year. for example, depositing ₹3,000 every year for 5 years.

Future Value of Annuity (FVA)

The formula for the future value of an annuity is:

FVA = CF × [(1 + r)ᵗ – 1] / r

Where:

- CF = Annual cash flow (₹3,000)

- r = Interest rate (10% = 0.10)

- t = Number of years (5)

- FVIFA = Future Value Interest Factor for Annuity

3. Present Value of a Single Cash Flow

Present value (PV) of the future sum (FV) to be received after a period T for which discounting is done at an interest rate of V is given by the equation.

In case of discrete discounting: PV = FV / (1+r)1

4. Present Value of an Annuity

The present value of an annuity is the sum of the present values of all the cash inflows of this annuity.

Present value of an annuity (in case of discrete discounting)

PVA = FV [{(1+r)1 – 1 }/ {r * (1+r)1 }]

What is effective annual return?

Effective Annual Return (EAR) is a rate of return on an investment over a year after accounting for compounding. It tells you how much your money actually grows, not just the advertised rate.

Why EAR is higher than the stated rate

The stated annual interest rate, which is also called the nominal rate, assumes interest is paid once a year. But most financial products, like fixed deposits, bonds, or savings accounts, compound interest more frequently: monthly, quarterly, or daily.

How to go about systematically analysing a company?

You must look for the following to make the right analysis:

Industry Analysis: Companies producing similar products are a subset (form a part) of an industry/sector. For example, National Hydroelectric Power Company (NHPC) Ltd, National Thermal Power Company (NTPC) Ltd, Tata Power Company (TPC) Ltd, etc., belong to the power sector/industry of India. It is very important to see how the industry to which the company belongs is faring. Specifics like the effect of government policy, future demand of its products, etc. need to be checked.

Corporate Analysis: How has the company been faring over the past few years? Seek information on its current operations, managerial capabilities, growth plans, past performance vis-a-vis its competitors, etc. This is known as corporate analysis.

Financial Analysis: If the performance of an industry as well as of the company seems good, then check if, at the current price, the share is a good buy. For this, look at the financial performance of the company and certain key financial parameters like Earnings Per Share (EPS), P/E ratio, current size of equity, etc.

What is an annual report?

An annual report is a formal financial statement issued yearly by a corporation. The annual report shows assets, liabilities, revenues, expenses and earnings – how the company stood at the close of the business year and how it fared profit-wise during the year – as well as other information of interest to shareholders.

Which features of an annual report should one read carefully?

One must read an annual report with emphasis on the following:

- Director’s Report and Chairman’s statement, which are related to the current and future operational performance of a company.

- Auditors’ Report (including Annexure to the Auditors’ Report)

- Profit and Loss Account.

- Balance Sheet.

- Notes to accounts attached to the balance sheet.

What is a balance sheet and a profit and loss account statement? What is the difference between the balance sheet and profit and loss account statements of a company?

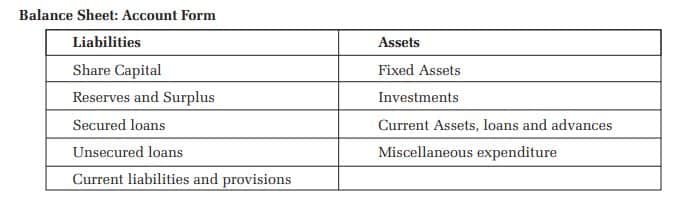

The balance sheet of a company shows the financial position of the company at a particular point in time. The balance sheet of a company/firm, according to the Companies Act, 1956, should be either in the account form or the report form.

Balance Sheet: Report Form

I. Sources of Funds

- Shareholders’ Funds

- Share Capital

- Reserves & surplus

- Loan Funds

- Secured loans

- Unsecured loans

II. Application of Funds

- Fixed Assets

- Investments

- Current Assets, loans and advances Less: Current liabilities and provisions Net current assets

- Miscellaneous expenditure and losses

How to interpret Balance Sheet and Profit and Loss Account of a company?

Let’s st start with Balance Sheet. The Box-1 gives the balance sheet of XYZ Ltd. company as on 31 March 2005. Let us understand the balance sheet shown in the Box-1.

Disclaimer: We have taken an effort to provide you with the accurate handout of “Concepts and Modes of Analysis Class 10 Notes“. If you feel that there is any error or mistake, please contact me at anuraganand2017@gmail.com. The above CBSE study material present on our websites is for education purpose, not our copyrights.

All the above content and Screenshot are taken from Introduction to Financial Markets Class 10 NCERT Textbook, CBSE Sample Paper, CBSE Old Sample Paper, CBSE Board Paper and CBSE Support Material which is present in CBSEACADEMIC website, NCERT websiteThis Textbook and Support Material are legally copyright by Central Board of Secondary Education. We are only providing a medium and helping the students to improve the performances in the examination.

Images and content shown above are the property of individual organizations and are used here for reference purposes only. For more information, refer to the official CBSE textbooks available at cbseacademic.nic.in

This is truly an awesome resource!! Clear mentioning of the formulae and good answers make it easier to learn than flipping through the whole book! Defenitely worth trying ^0^