Financial planning is the process of setting financial goals, creating a budget, managing income and expenses, and making informed decisions about saving and investing. In Class 9, financial planning is introduced to help students understand the importance of managing money wisely, preparing for future needs, and achieving financial security.

What is Financial Planning Class 9 Notes

Financial planning is the process of defining goals, developing a plan to achieve them, and putting the plan into action. It’s like a blueprint for handling all aspects of your money, including spending, saving and investing.

Financial planning is an ongoing thinking process. The most important part of financial planning is knowing yourself. What do you want to be? What do you want money to do for you? What kind of career do you want? Where do you want to live? What kind of car do you want to own?

The answers to these questions all involve money, to one degree or another. With rare exceptions, most of us do not have enough money to do everything we want. Instead we have to make choices and tradeoffs because we have limited amounts of time and money and limited resources. To help make those choices, a good financial plan distinguishes between needs and wants.

Needs vs. Wants

Needs are important, the basics of life like food, clothing and a place to live, etc. Wants simply to increase the quality of living. Needs and resources are limited, but wants are unlimited. Going to movies, eating out, and going on a vacation are wants. Wants are fun and interesting to do, and there’s nothing wrong with wants. However, for people with a limited amount of money, needs are the foremost priority.

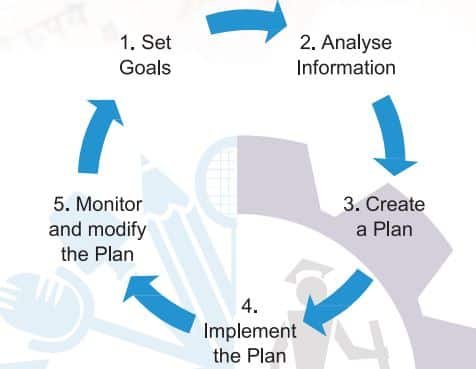

Steps in financial planning:

- Step 1: Setting Goals

- Step 2: Analysing Information

- Step 3: Creating a Plan

- Step 4: Implementing the Plan

- Step 5: Monitoring and modifying the plan

Step 1: Setting Goals

The most important thing is to identify your goals clearly. The goals should always be in writing and should be meaningful to you. Goals should always be defined in a smart way.

- S (Specific): The goal set must be specific. What you want to achieve is to be specific. Specific goal setting will lead to a plan and work towards that.

- M (Measurable): Goals set are to be measurable in nature. Measurable means that you must know how much you require to achieve the set goal.

- A (Attainable): The goal set must be reachable for you. If it is not reachable, you cannot attain your goal.

- R (Realistic): The goal set by you must be realistic. It means the goal set by you should have the possibility of doing it. If it is not possible to do a particular thing, all your effort will be in vain.

- T (Time-bound): The goal set by you must specify a particular time period in which you will achieve the goal.

Sample SMART Goal Timelines

- Short-term: A goal planned to be achieved within a day or a week or a month or within three months. Short-term goals have a time frame of up to three months.

- Intermediate-term: A goal planned to be achieved in a few months or within a year. Intermediate-term goals take place between three months and one year.

- Long-term: Goal planned to be achieved after a year. Long-term goals are more than a year. Those long-term goals required patience to achieve.

Step 2: Analysing Information

The second step is to analyse yourself, like where you are now. How do you get money? Do you receive an allowance? How much do you get each week? How much do you spend each week? What do you normally spend your money on? Answers to questions like these help pinpoint where you are financially. It helps you to understand your financial resources so that you can plan your next step.

Step 3: Creating a Plan

Once the information is available, then start the planning of finance-related goals. The plan should be based on how much money you have, how much you can save, etc.

Step 4: Implementing the Plan

Invest the money wisely so that your goal is achieved as per your plan. If you handle it wisely and respectfully, you take personal responsibility for your actions and decisions. Find someone who will help you to set the goals like your parents.

Step 5: Monitoring and modifying the plan

After creating a plan, be aware you may need to change it over time. You will run into unexpected obstacles. Your goals may change; you may add new goals, or your resources may change.

Beneficiaries of Financial Planning

It is useful to everyone. There are many instances of highly paid employees who came to financial grief merely because they did not plan for their post-career years. Similarly, even people earning small amounts of income should undertake this process, as it will help them in prioritising their goals so that their limited income can be used more efficiently. “Little drops of water make the mighty ocean.”

Disclaimer: We have taken an effort to provide you with the accurate handout of “What is Financial Planning Class 9 Notes“. If you feel that there is any error or mistake, please contact me at anuraganand2017@gmail.com. The above CBSE study material present on our websites is for education purpose, not our copyrights.

All the above content and Screenshot are taken from Introduction to Financial Markets Class 9 NCERT Textbook, CBSE Sample Paper, CBSE Old Sample Paper, CBSE Board Paper and CBSE Support Material which is present in CBSEACADEMIC website, NCERT websiteThis Textbook and Support Material are legally copyright by Central Board of Secondary Education. We are only providing a medium and helping the students to improve the performances in the examination.

Images and content shown above are the property of individual organizations and are used here for reference purposes only. For more information, refer to the official CBSE textbooks available at cbseacademic.nic.in