Saving means keeping aside a part of our income instead of spending it all. It is an important habit that helps us prepare for the future, meet emergencies, and achieve financial goals.

Why Save Class 9 Notes

What is saving?

Savings are the income that is not used for current expenses but reserved for the future. If you have a saving, then it allows you to enjoy the things that you wish to do, such as vacations in a nice hill station.

Disposable Income and Saving

- Disposable income = spending + saving

- Saving = disposable income – spending (expenditure)

Disposable income is the money you have left after paying taxes. It can be from your salary, business earnings, or even gifts like birthday money, etc. Buying the things that you want is called spending. If you do not spend the money and keep it aside, it is called saving. The money you have saved earns interest. Interest allows your money to grow and become more than what you originally saved. In short, money saved is money earned. The interest is usually paid by a bank or a company where you have deposited the money you have saved. There are generally two types of interest you can earn. These are

Simple Interest

In simple interest, the interest is calculated only on the principal you deposited. The formula for simple interest is

Simple Interest = (P x R x T) / 100

where:

- P = Principal (initial amount)

- R = Rate of interest (%)

- T = Time (in years)

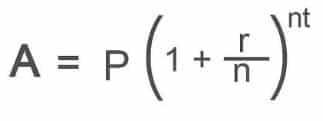

Compound Interest

The interest is calculated on the principal plus the interest earned in previous periods. Compound interest allows savings to grow dramatically over the long term. This is also known as compounding (interest on interest).

The Rule of 72, or doubling period

The Rule of 72 is a quick method to understand how long it will take for the money to double at a given compound interest rate. It helps to plan your savings and investments. The method shows how interest grows your money over time and helps to encourage smart financial decisions.

Doubling Period (in years) = 72 ÷ Interest Rate

Suppose,

- Initial Saving: 100 Rs

- Interest Rate: 8%

- The formula is 72 / 8 = 9 years.

Disclaimer: We have taken an effort to provide you with the accurate handout of “Why Save Class 9 Notes“. If you feel that there is any error or mistake, please contact me at anuraganand2017@gmail.com. The above CBSE study material present on our websites is for education purpose, not our copyrights.

All the above content and Screenshot are taken from Introduction to Financial Markets Class 9 NCERT Textbook, CBSE Sample Paper, CBSE Old Sample Paper, CBSE Board Paper and CBSE Support Material which is present in CBSEACADEMIC website, NCERT websiteThis Textbook and Support Material are legally copyright by Central Board of Secondary Education. We are only providing a medium and helping the students to improve the performances in the examination.

Images and content shown above are the property of individual organizations and are used here for reference purposes only. For more information, refer to the official CBSE textbooks available at cbseacademic.nic.in