In Financial Accountancy, the Money Exchange System refers to the process of using money as a common medium for buying and selling goods or services, replacing the limitations of the barter system. For Class 9, this topic provides a foundation for understanding how money works in trade.

Money Exchange System Class 9 Notes

In early times, people only focused on survival by finding food, water, and shelter, but later on, they started making better tools, growing more food, and creating useful things. This led to specialising in one skill and becoming experts. Because of specialisation, people need to trade, like a farmer could trade food for clothes made by a tailor. This kind of trade is called bartering, which means giving one thing to get another. Specialisation helps people to make better quality goods, trade more, and get more things they need.

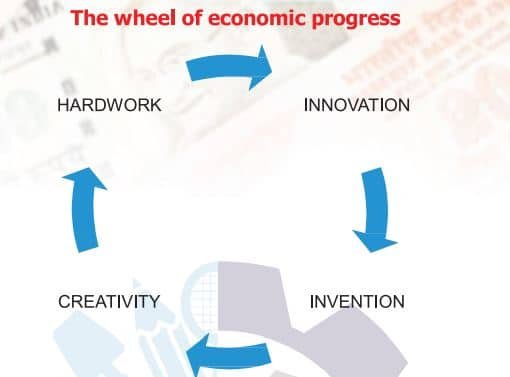

Because of this, people become more creative and start inventing new things, which helps the economy to grow. People work hard, and they use their skills to make better goods. A person focuses on one type of work, like a carpenter making furniture, while a farmer grows crops. When Europeans came to North America, they started trading with Red Indians. The Red Indians are good hunters and have animal furs to trade. Europeans give tools, cloth, or weapons in exchange for animal furs. This type of trading is known as barter, which means trading goods without using money.

When societies grew, then the barter became difficult to trade; people needed more goods, and it became harder to find someone who wanted to trade exactly what you had. To solve this type of problem, commodity money was introduced, like salt, shells, or metal. But commodities as money had other problems; carrying bags of salt and other commodities was hard, and they were difficult to store. Therefore, people started using metal objects as coins and later paper as money. These were more convenient than salt, tea, and seeds.

Coins and Paper Money

Money evolved over thousands of years around 5000 B.C. These metals were used because the raw materials are easily available, durable, and easy to recycle. The first coins were introduced in 700 B.C., which helped standardise trade by assigning fixed values to different denominations. Later, around 806 AD, China became the first country to use paper money. In India, our currency is the rupee, and its smaller unit is the paisa.

Modern Currencies

In modern societies the coins and paper money are the most commonly used forms of money. Money is also called currency or a unit of exchange. In India we pay money in the form of rupees to buy things. We also pay in paise, which are called fractional rupees. Every country has its own currency, such as the dollar in the USA or the yen in Japan. These currencies play important roles in both local and international trade.

Disclaimer: We have taken an effort to provide you with the accurate handout of “Money Exchange System Class 9 Notes“. If you feel that there is any error or mistake, please contact me at anuraganand2017@gmail.com. The above CBSE study material present on our websites is for education purpose, not our copyrights.

All the above content and Screenshot are taken from Introduction to Financial Markets Class 9 NCERT Textbook, CBSE Sample Paper, CBSE Old Sample Paper, CBSE Board Paper and CBSE Support Material which is present in CBSEACADEMIC website, NCERT websiteThis Textbook and Support Material are legally copyright by Central Board of Secondary Education. We are only providing a medium and helping the students to improve the performances in the examination.

Images and content shown above are the property of individual organizations and are used here for reference purposes only. For more information, refer to the official CBSE textbooks available at cbseacademic.nic.in