The Primary Market is an essential part of the financial system where companies issue new securities to raise funds directly from investors. In Class 10 introduction to financial markets, the topic explains how organizations raise capital, the different methods of issuing shares, and the role of various financial institutions.

Primary Market Class 10 Notes

What is the role of the ‘Primary Market’?

The primary market provides the channel for the sale of new securities. The primary market provides an opportunity for issuers of securities, government as well as corporates, to raise resources to meet their requirements of investment and/or discharge some obligation.

Face value is the basic value of a financial product like a share or a bond. This face value is decided by the company or government when they first create it. It is an original price written on a financial product. The face value is usually a small number like 5 rs or 10 rs, but when the people buy or sell the share, the price can be much higher, like 100 rs or 200 rs. When the bonds end, then you will get back the amount.

Securities are generally issued in denominations of 5, 10 or 100. This is known as the face value or par value of the security, as discussed earlier. When a security is sold above its face value, it is said to be issued at a premium, and if it is sold at less than its face value, then it is said to be issued at a discount.

If anyone wants to start the company, they require money. This money is fulfilled by the promoter, founders and bank loans, but this money is not sufficient for long-term business. So, the company invites the public to contribute to the company using equity and shares. So they invite the public to invest by buying shares; this process is called a public issue.

What are the different kinds of issues?

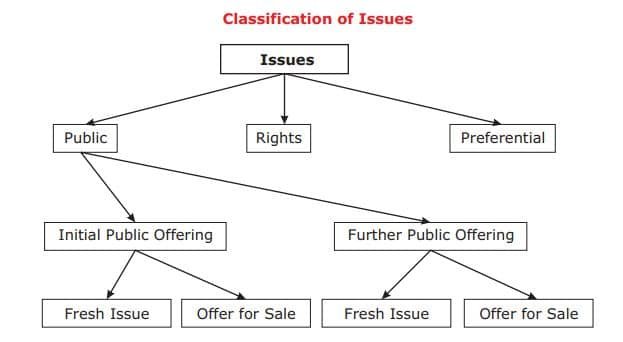

Companies raise capital through different types of share issues, which are mainly classified into public issues, rights issues, and preferential issues, which are also called private placements. While public and rights issues involve a detailed procedure, private placements or preferential issues are relatively simpler. The classification of issues is illustrated below:

- IPO (Initial Public Offering): When the private company or unlisted company issues shares publicly for the first time. The purpose is to raise capital and gain public visibility.

- Follow-on Public Offering (FPO): A company already listed on the stock market and wants more money. It sells more shares to the public.

- Right Issue: A listed company wants to raise money from its current shareholders. It offers extra shares at a discount rate.

- Preferential Issue: A company gives shares to a specific group of people, not for the general public; it is a quick way to raise money.

What is meant by issue price?

The price at which a company’s shares are offered initially in the primary market is called the issue price. When they begin to be traded, the market price may be above or below the issue price.

What is meant by market capitalisation?

The market value of a quoted company, which is calculated by multiplying its current share price (market price) by the number of shares in issue, is called market capitalisation. E.g., Company A has 120 million shares in issue. The current market price is Rs. 100. The market capitalisation of company A is Rs. 12000 million.

What is the difference between a public issue and a private placement?

A public issue is open to everyone and generally done via IPO or FPO. If 50 or more people are allotted shares, it is considered a public issue under the Companies Act, 1956. Private placements are made to a select group of investors and are not open to the general public. As per the Companies Act, less than 50 people can be allotted shares for it to qualify as a private placement.

What is an Initial Public Offering (IPO)?

An Initial Public Offering (IPO) is the selling of securities to the public in the primary market. It is when an unlisted company makes either a fresh issue of securities or an offer for sale of its existing securities or both for the first time to the public.

Who decides the price of an issue?

Since 1992, Indian companies have had the freedom to set their own IPO prices. SEBI does not fix the price, but the company has to disclose how it was decided. There are two pricing methods: fixed price and book building. Fixed price, where the price is set in advance, and book building, where a price band is given and the final price is discovered based on investor demand.

What does ‘price discovery through the book-building process’ mean?

Bookbuilding is a method used during an IPO to discover the best price for the shares. The company does not set a fixed price; the company provides a price band. Investors then place bids for how many shares they want and at what price within that band. After the ending of the bidding period, the company analyses and sets the final offer price based on those bids.

In a fixed-price issue, the company decides the price of each share before the IPO starts, but you know the price when you apply. You don’t know how many people are buying until the IPO ends.In the book-building issue, the company gives a price range like 100 to 120. Investors place the bids withinthis range, and the final price is decided after seeing how much demand there is. You can see the daily updates on how many people are bidding.

- Fixed Price = MRP tag on a product.

- Book building = Auction where people bid, and the highest demand sets the price.

What is the cut-off price?

After the bidding ends, the company manager analyses all the bids to find the price at which demand is strong enough to sell all shares; this final price is called the cut-off price.

What is the floor price in case of book building?

The floor price is the minimum price at which bids can be made.

What is a price band in a book-built IPO?

The company has to mention the minimum bid price, which is known as the floor price, or a price band, which means the range of acceptable bid prices in the IPO prospectus. The cap price must not exceed the floor price. If the company decides to change the price band, then it must inform the public widely, notify stock exchanges, issue a press release and update websites and trading terminals. The bidding period gets extended by 3 days, but the total bidding period can not exceed 10 days.

Who decides the price band?

It may be understood that the regulatory mechanism does not play a role in setting the price for issues. It is up to the company to decide on the price or the price band, in consultation with merchant bankers.

What is the minimum number of days for which a bid should remain open during book building?

The book should remain open for a minimum of 3 days.

Can the open outcry system be used for bookbuilding?

No. As per SEBI, only an electronically linked transparent facility is allowed to be used in the case of book building.

Can the individual investor use the book-building facility to make an application?

Yes.

As per the SEBI regulations, 2009. The basis of allotment must be finalised within 8 days from the closure of the issue. Once it is completed, the issuer has to credit the allotted shares to the investor’s demat account and dispatch the refund order withinthe next 2 working days.Therefore, an investor should know within approximately 11 days from the closure of the issue whether shares have been allotted to them or not.

It takes 12 working days after the closure of the book-built issue.

What is the role of a ‘Registrar’ in an issue?

The Registrar finalises the list of eligible allottees after deleting the invalid applications and ensures that the corporate action for crediting of shares to the demat accounts of the applicants is done and the dispatch of refund orders to those applicable is sent.

Does NSE provide any facility for IPO?

The NSE nationwide electronic trading system helps investors in the remote area to take part in IPOs. To make this easier, NSE introduced online IPOs using the book-building method. It uses a system called NEAT IPO.

Book building through the NSE system offers several advantages:

- The NSE system offers a nationwide bidding facility in securities.

- It provides a fair, efficient & transparent method for collecting bids using the latest electronic trading systems.

- Costs involved in the issue are far less than those in a normal IPO.

- The system reduces the time taken for completion of the issue process.

What is a prospectus?

Many new companies launch public issues; while some are trustworthy, some can try to mislead investors. SEBI requires companies to share detailed information with the public through a document called the Prospectus. The prospectus gives the details of the company, about how the company is growing, the promoters’ background and legal compliances. This helps the investors to make decisions about both short-term and long-term prospects.

What does ‘Draft Offer document’ mean?

‘Draft Offer document’ means the offer document in the draft stage. The draft offer documents are filed with SEBI at least 30 days prior to the registration of the red herring prospectus or prospectus with ROC. SEBI may specify changes, if any, in the draft offer document, and the issuer or the lead merchant banker shall carry out such changes in the draft offer document before filing the Offer Document with ROC. The Draft Offer Document is available on the SEBI website for public comments for a period of 21 days from the filing of the Draft Offer Document with SEBI.

What is an ‘Abridged Prospectus’?

‘Abridged Prospectus’ is a shorter version of the Prospectus and contains all the salient features of a Prospectus. It accompanies the application form of public issues.

Who prepares the ‘Prospectus’/‘Offer Documents’?

Generally, the public issues of companies are handled by ‘merchant bankers’ who are responsible for getting the project appraised, finalising the cost of the project, profitability estimates and preparing the ‘prospectus’.

What does one mean by ‘lock-in’?

‘Lock-in’ means that certain shares cannot be sold for a fixed period. According to SEBI rules, promoters—those who control the company—must keep a minimum percentage of shares after the public issue.

What is meant by ‘Listing of Securities’?

Listing means admission of securities of an issuer to trading privileges (dealings) on a stock exchange through a formal agreement.

What is a ‘Listing Agreement’?

The listing agreement specifies the terms and conditions of listing and the disclosures that shall be made by a company on a continuous basis to the exchange.

What does ‘delisting of securities’ mean?

The term ‘delisting of securities’ means permanent removal of securities of a listed company from a stock exchange. As a consequence of delisting, the securities of that company would no longer be traded at that stock exchange.

What is SEBI’s Role in an Issue?

Any company making a public issue or a listed company making a rights issue of value of more than Rs 50 lakh is required to file a draft offer document with SEBI for its observations.

Does it mean that SEBI recommends an issue?

SEBI does not endorse or guarantee any public issue or project. It doesn’t take responsibility for the financial health of the company or the accuracy of statements in the offer document. SEBI’s main role is to ensure that companies provide clear and complete disclosures in the prospectus so investors can make informed decisions.

Does the SEBI tag make one’s money safe?

Investors must make their own decisions based on the details provided in the offer documents. SEBI does not endorse or guarantee any company or investment. Before investing, it’s important to carefully review all facts and risks mentioned in the document. Relying on rumours or unofficial tips is strongly discouraged.

Foreign Capital Issuance

Can companies in India raise foreign currency resources?

The Indian companies can raise funds in foreign currency through two main methods.

- Foreign Currency Convertible Bonds (FCCBs): these are also called Euro issues. These are bonds issued in foreign currency which can later be converted into shares of the company.

- Depository Receipts: Depository receipts, like Global Depository Receipts (GDRs) and American Depository Receipts (ADRs), are for foreign investors who invest in Indian companies by buying shares listed overseas.

What is an American Depository Receipt?

An American Depositary Receipt (“ADR”) is a physical certificate evidencing ownership of American Depositary Shares (“ADSs”). The term is often used to refer to the ADSs themselves.

What is an ADS?

An American Depositary Share (“ADS”) is a U.S. dollar-denominated form of equity ownership in a non-U.S. company. It represents the foreign shares of the company held on deposit by a custodian bank in the company’s home country and carries the corporate and economic rights of the foreign shares, subject to the terms specified on the ADR certificate.

What is meant by Global Depository Receipts?

Global Depository Receipts (GDRs) may be defined as a global finance vehicle that allows an issuer to raise capital simultaneously in two or more markets through a global offering.

Disclaimer: We have taken an effort to provide you with the accurate handout of “Primary Market Class 10 Notes“. If you feel that there is any error or mistake, please contact me at anuraganand2017@gmail.com. The above CBSE study material present on our websites is for education purpose, not our copyrights.

All the above content and Screenshot are taken from Introduction to Financial Markets Class 10 NCERT Textbook, CBSE Sample Paper, CBSE Old Sample Paper, CBSE Board Paper and CBSE Support Material which is present in CBSEACADEMIC website, NCERT websiteThis Textbook and Support Material are legally copyright by Central Board of Secondary Education. We are only providing a medium and helping the students to improve the performances in the examination.

Images and content shown above are the property of individual organizations and are used here for reference purposes only. For more information, refer to the official CBSE textbooks available at cbseacademic.nic.in