Income is the money or other benefits that a person, business, or organization receives in exchange for providing goods, services, or through investments. In Class 9, income is explained as a key concept in economics and business studies, helping students understand different sources of income such as wages, salaries, profits, rent, and interest.

What is Income Class 9 Notes

Income means the money earned by an individual or business through various sources. Income is the money earned, whether from salary, business, profession, renting a property, sales of assets, gifts, interest on deposits or any other source. Most people think of income as money earned from a job. Let’s see a more creative view on incomes.

- Do you receive an allowance? You’ve got an income.

- Do you get money on your birthday? That’s income too.

- Does a doctor, lawyer or engineer get fees for his/her service? It is an income.

- When you have a job, you will receive a monthly salary or pay cheque, which is called income.

- If your father or mother has a job or is a businessman, and he/she receives payment or profit, that is income.

- Winnings from lotteries, card games, etc. are also treated as income.

- Gain on the sale of a house property will be considered as income.

What is gross income?

The gross income is the total amount of income from the following sources of income.

- Salary income for the work one does.

- Profits from your business and fees received for the service one does.

- Rental income from renting properties.

- Gain on sale of properties and other assets.

What is net income?

The net income is the income after subtracting the deduction allowed under the provision of the Income Tax Act.

What is salary income?

Salary income is the amount you earn for working at the office for a certain period. Usually salaries are paid on a monthly basis. But what you receive in your pay cheque is not the gross pay; it is a net pay. Deductions are amounts subtracted from your gross pay, like income tax, lunch charges or provident fund, etc. Income tax is a fee or levy charged by the government on the income earned by an individual.

What is tax?

In salary, the tax is the biggest deduction. These taxes pay for a variety of services we all appreciate and use, like the armed forces, road maintenance, railways, etc. Taxes are classified into two types: direct tax and indirect tax. Direct tax is the tax imposed by the government on one person and paid by the same person. Example: income tax. Indirect tax is the tax imposed by the government on one person and actually paid by another person. For example, service tax.

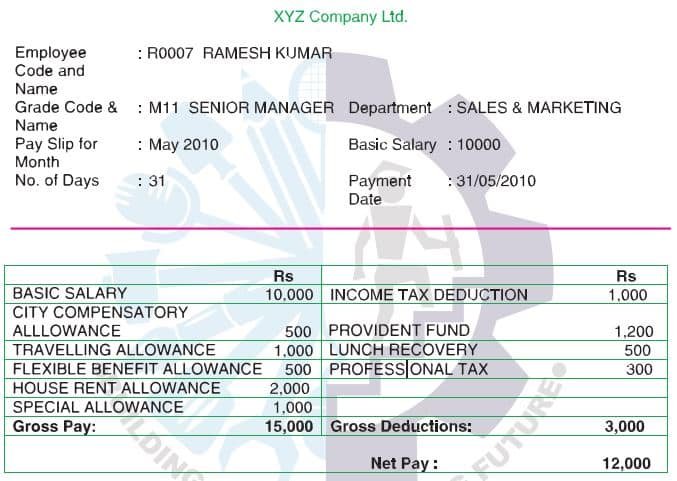

Mr Ramesh works at XYZ Company Ltd as a senior manager. This is a salary slip for the month of May 2010. The gross salary of Mr Ramesh is 15000, which is given on the left-hand side, and the deductions are 3000 Rs, which is given on the right-hand side. You see that the net pay is less than the gross pay in the salary slip. All the salary slips may not have the same items as shown on the above image; it may vary from company to company. The various salary incomes are categorised under different heads, such as basic pay, city compensatory allowance, etc. These allowances are an amount given by the company and form part of the gross pay.

Disclaimer: We have taken an effort to provide you with the accurate handout of “What is Income Class 9 Notes“. If you feel that there is any error or mistake, please contact me at anuraganand2017@gmail.com. The above CBSE study material present on our websites is for education purpose, not our copyrights.

All the above content and Screenshot are taken from Introduction to Financial Markets Class 9 NCERT Textbook, CBSE Sample Paper, CBSE Old Sample Paper, CBSE Board Paper and CBSE Support Material which is present in CBSEACADEMIC website, NCERT websiteThis Textbook and Support Material are legally copyright by Central Board of Secondary Education. We are only providing a medium and helping the students to improve the performances in the examination.

Images and content shown above are the property of individual organizations and are used here for reference purposes only. For more information, refer to the official CBSE textbooks available at cbseacademic.nic.in